HOW'S YOUR LIFE PLANNING GOING?

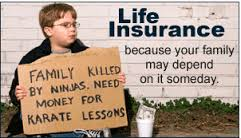

We all have good intentions in life...but how many are still procrastinating? It's never too late to start, but you must get started...like now!

Let me ask you a couple of Questions.

Have you had any of these Life changes?

-

Just Got Married?

-

Newborn Child?

-

New Home?

-

Promotion at Work?

If you answer yes to any of these questions, then it's definitely time to start taking your life planning more serious.

So let's get started.

The investment world can be intimidating. The amount of information is staggering. Some people love to research and monitor their own investments; many do not.

Before you get started, ask yourself a few questions and answer honestly.

-

Do you have the knowledge to research investment options?

-

Do you have the time to adequately research options?

-

Do you have the time to properly manage your investments?

-

Do you have the temperament to manage your investments?

If you answered no to any of the above...

Then you're really going to love us!!

Seriously, if you answered no to any of the above questions, you're probably better off working with a firm like ours.

ONE SIMPLE RULE OF INVESTING FOR YOUR FUTURE IS......

THE EARLIER YOU START, THE BETTER YOU FINISH!!

Albert Einstein called compound interest the 8th wonder of the world! For example, if you are 30 years old and you plan to retire at 65, invest $200 a month, (7% earned) you will have $356,796 at age 65.

Wait 10 years until you're 40 and follow the same path, you only end up with $160,992. That's almost $200,000 less.Ten years makes a huge difference. Now you see why we said earlier that you need to do this...NOW!

If your company offers a 401k plan, do you have a large number of investment options? Deciding how to allocate your 401k contribution can be a daunting task. We can help. We can review your investment choice, design an investment plan for you and monitor the plan.

A 401k plan is not the only investment option available. Many options are available outside of the 401k. Roth IRA, Traditional IRA, SEP-IRA, brokerage accounts are a few of the most widely used options. Which one is best for you? We can help.

Spend a few minutes with us to discuss your objectives and we’ll explain how each option works and which is best for you. We can design and monitor an investment plan for you.

Now is the Time....Let's get started!!